Only during the last week of April, the IRS planned to process over 17 million tax returns. The deadline was drawn precisely – on 17th of April. Obviously, all taxpayers must be on time with their income tax reports.

Despite having all necessary information in advance, lots of people still manage to miss the time window. However, you do not need to start panicking since you can simply file for an extension. This is a way to postpone your tax returns for people who are not ready to file their taxes.

Now, some people are always ready. This means that you must know how to properly report your income to the IRS. The first thing you must decide is whether you want to pay by check or file a return. You know the due date (for example, 17th of April) and must send a first-class letter before or on that date. Everything should be fine if you do that.

The IRS may claim that your return was not received in time. Sadly, you don’t have any means to prove that you sent the letter if you did not receive a documented proof. This is why you should always opt for registered mail. This will put the blame on the mailing service.

All returns that were received on time are found in §7502 (c)(1) of 26 USC.

The paragraph says that these registrations must be considered a proof that documents were sent and delivered to the agency and that the date of the registration is the date on the postmark.

This means that if you used registered mail, you will have all necessary evidence that you are a law abiding taxpayer. This is why the first-class mailing is not the best choice in case something goes wrong with the delivery. Unfortunately, mailing services do have problems with managing stuff sent by people and some letters do get lost.

When planning ahead and thinking about filing your taxes correctly, don’t forget that the only real way to prove that a document was sent in due time is another document that will serve as an evidence.

Don’t play a Scrooge and pay that extra couple of dollars to send a certified mail and have a proper evidence of sending.

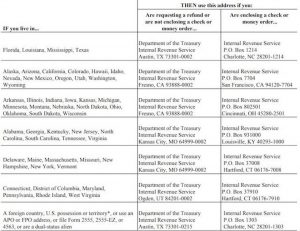

The next thing to consider is how you fill the tax form. It is imperative to correctly state where you live and where you are registered.

Here’s an IRS chart that has all necessary information:

You may also live outside of 50 states. In such case follow this rule:

Double check everything that you are putting in the form in order to avoid legal problems later on.

One thing that we can all thank the U.S. Post Office is that they decided to extend business hours on April 17 (they do it on every tax day so don’t be too kind to them). Post Offices usually close by 6 p.m. You can find locations by using the PO location service.

There is yet another way to send your tax returns.

You can use various private delivery companies. There are several groups of companies that will provide necessary evidence that you sent a document to the IRS:

- UPS services including the UPS Worldwide Express.

- FedEx services including the International Economy.

- DHL including Import Express Worldwide.

Obviously, you can receive additional information about delivery types and methods as well as whether they will be accepted by the IRS in all offices of mentioned delivery systems.

All of these hassles can be easily avoided by using the online service. The IRS encourages all taxpayers to use e-filing which will be processed faster. Choosing this method will not affect how you can pay your taxes.

Despite the simplicity of the process, many taxpayers may still require help. If you need a step-by-step guide from an IRS specialist, don’t shy away from calling the 1-800-829-1040. The customer service department operates during business hours on business days.